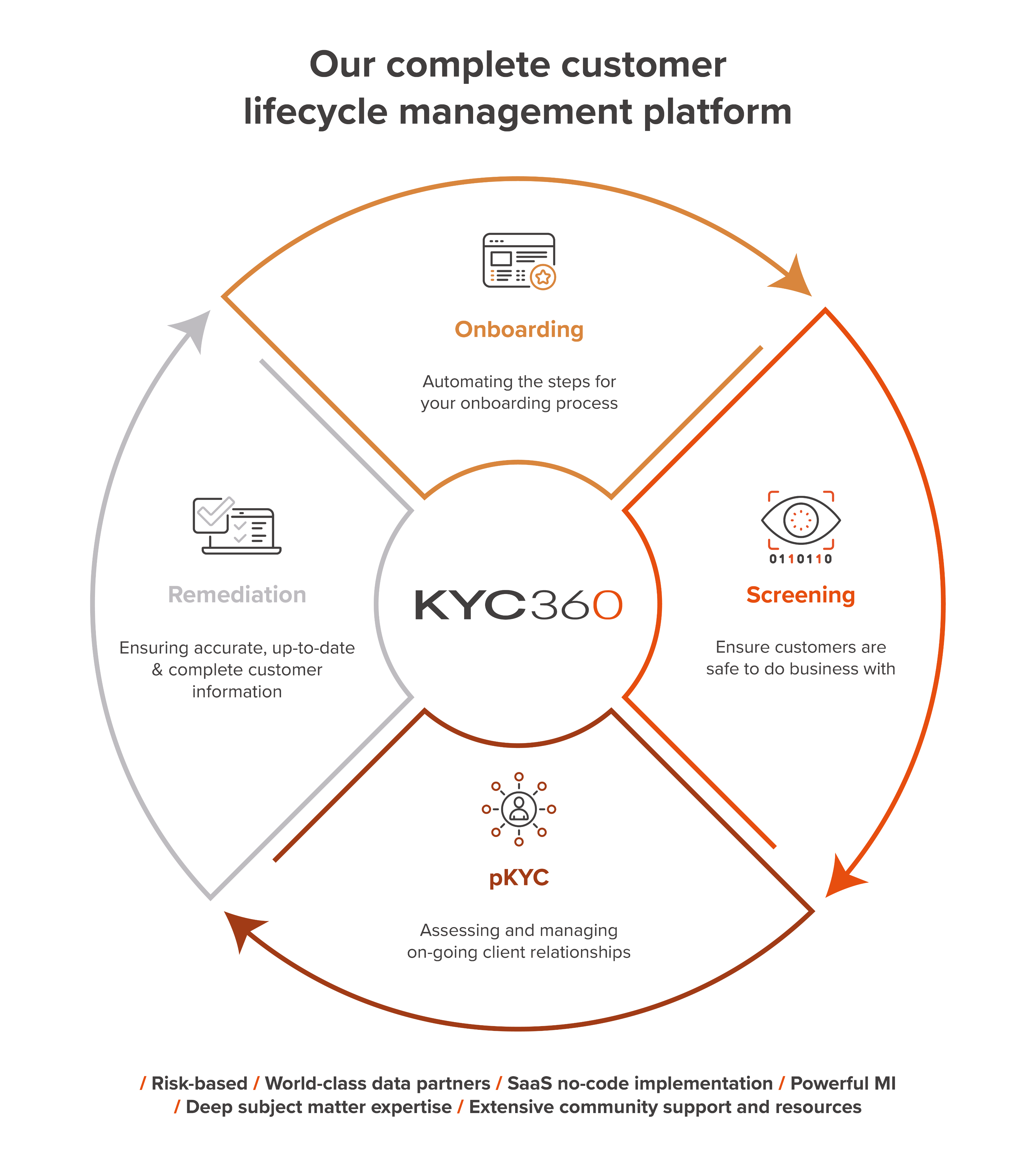

Screening

Overview

Whether you need to do the occasional ad-hoc screening check, or monitor millions of customers overnight, KYC360 has the right solution for you. Our unique and award-winning 3D risk-based approach to screening ensures that your false positives are minimised with no compromise on true matches. Our focus on rapid ROI allows you to deploy and configure the solution in no time at all.

The KYC360 screening solution is integrated with data sets from all of the world’s leading data providers including Dow Jones, World-Check and Lexis Nexis allowing you maximum flexibility and optionality.

KYC360 is the first and only screening solution to employ meta-data improvement techniques to increase the accuracy of input data used as the source for screening. The result is a reduction in false-positives by two-thirds compared to major competitors.

Whether utilised onsite or as a SaaS solution with fully featured API our screening solutions generate significant operational efficiencies whilst boosting your compliance performance.

Benefits

Batch Screening

The KYC360 Batch screening solution is an award-winning technology that enables businesses to automatically screen customer names and meta-data on a continuous basis utilising the risk-based approach. Capable of screening anything from just a few hundred names to tens of millions of names overnight the solution can handle huge volumes at all risk levels giving businesses the assurance they need to evidence compliance with the risk-based approach irrespective of volumes.

At KYC360 we know that screening results are directly impacted by the quality of input data. If you put poor quality data in you are more likely to get poor results out. Unlike most screening technology vendors that rely solely on algorithms to compensate for poor data quality we help you to identify and correct defects in your input data through a self-service data quality assessment tool that comes as part of our screening solution. KYC360 is the only screening provider in the world to offer this functionality as a core component of its screening solution because we recognise that there cannot be effective screening without stringent quality control of input data. The input data quality assessment function will check and provide you with a report on any data quality issues giving you the chance to take remedial steps and optimise your screening results.

- Virtually eliminate false positives with the world’s first truly risk-based batch screening engine

- Handle tens of millions of names. Our screening solution can handle huge volumes at all risk levels

- Fully integrated with the world's best data sets from Dow Jones. World-Check and Lexis Nexis providing you with maximum optionality

- Complete workflow and audit capture – All activity at any single moment in time is captured for audit purposes

- Laser-sharp MI and reporting

- Super-flexible integrations

Adverse Media Monitoring

Screening customers against adverse media sources on a continuous basis is now regarded as essential by businesses attempting to manage risk effectively. It is an important component of customer due diligence particularly for higher risk customers.

KYC360’s adverse media monitoring function operates as an optional component of our Batch screening solution so that screening results are captured and handled in one place. With full open source coverage, our award-winning functionality minimises false positives while maximising search accuracy.

- Store results alongside your sanctions, PEP & watch list screening records

- Subject AVM results to the same levels of audit & reporting as dataset screening

- Carry over handling of potential matches into periodic reviews

- Exclude hits which have already been viewed

- Refine search results by date and country

- Tailor searches by frequency or search terms

- Tailor searches by individual or groups of customers

- Massively reduce AVM false positive results with KYC360’s award-winning 3D risk-based technology

Ad Hoc Screening

The ability to quickly screen prospects or customers against datasets or adverse media sources on-line is essential. Our intuitive web-based manual screening solution ‘Risk Screen’ powered by KYC360 technology allows you and your employees to rapidly conduct manual screening across global sanctions, PEP and watchlist information provided by leading data provider Dow Jones as well as the whole of the world wide web from mainstream news to blog and social posts.

With no limit on the number of users you can deploy the use of RiskScreen across your organisation including front line staff and empower your first line of defence against financial crime.

- Screen individuals and companies online in real time

- Includes alias names for 'bad actors'

- Common name variants, across multiple languages

- Control risk-based search parameters

- Exclude irrelevant URLs

- Red flag results of interest

- Consolidate findings in a single report for future audit purposes

- Include your assessment of the search subject’s risk level based upon search results

- Add comments for improved communication

- Optional MRZ analyser allowing you to analyse and validate passport data

Data Quality

The quality of input data directly impacts screening results. Most providers rely solely on algorithms to compensate for poor data quality, with many employing a loose matching system that leads to numerous false positives and leaves true matches buried. But at KYC360, we help you to identify and correct defects in your input data through a self-service data quality assessment tool that comes as part of our Batch screening module.

KYC360 is the only Customer Lifecycle Management platform in the world to offer this functionality as a core component of its screening solution because we recognise that there cannot be effective screening without stringent quality control of input data. We are not passive recipients of your data. We actively optimise it for screening.

Salesforce App

Our API technology enables full headless integration of KYC360 with your core platform. In addition to dozens of other integrations we are proud of being the first screening provider in the world to be invited to build an integration with Salesforce, the world’s largest CRM provider. Our Salesforce native screening App is utilised by a large number of organisations for frictionless and automatic screening of leads and customers natively without the need for data import/export.

- Consolidate your system stack

- Save on tech licensing and support costs by eliminating your stand-alone

screening solution - Use KYC360 dashboards and workflow to allocate and handle potential

screening matches - Reduce false positives by up to 95% with KYC360’s award-winning 3D risk

based technology - Improve AML risk governance through full audit capture

- Comprehensive MI

- Integrated with world leading datasets

KYC360’s suite of Client Lifecycle Management software solutions is designed to transform your business processes enabling you to outperform commercially through operational efficiency gains and superior CX whilst remaining fully compliant with evolving regulatory standards.